Analyzing the performance of the PSQ ETF involves a meticulous review of its underlying factors. Traditionally, investors evaluate the ETF's composition to gauge its exposure to various market segments. Furthermore, it is important to factor get more info in the ETF's past data, comprising its returns and risk.

By examining these dimensions, investors can develop a more informed view of the PSQ ETF's prospects.

A multifaceted strategy is essential for accurately analyzing the PSQ ETF's results.

ProShares Short QQQ ETF Returns

Diving into the track record of the ProShares Short QQQ ETF (PSQ) reveals a complex landscape. This ETF aims to provide inverse exposure to the Nasdaq-100 Index, making it a popular choice for speculators seeking to mitigate their portfolio risk during periods of market uncertainty. While PSQ has generated substantial returns in certain market situations, it's crucial to understand the inherent risks associated with shorting the market.

- Elements such as interest rates, inflation, and global economic dynamics can significantly influence PSQ's outcomes.

- It's essential for investors to conduct thorough due diligence before allocating capital to PSQ, as its strategy may not be suitable for all appetites.

Finally, understanding the nuances of PSQ's returns is paramount for traders who consider incorporating it into their investment strategies.

Leveraging Short Positions with PSQ ETF harness

The ProShares UltraPro Short QQQ ETF (PSQ) offers a powerful approach to capitalizing on potential downturns in the technology sector. By employing short positions, investors can generate returns when the NASDAQ 100 index declines. However, it's crucial to thoroughly consider market conditions and risk tolerance before utilizing PSQ in your portfolio.

Navigating Market Volatility with PSQ: ETF Performance Insights

As traders contend with the inevitable fluctuations of financial markets, seeking proven investment vehicles is paramount. The ProShares Ultra QQQ (PSQ) ETF presents an intriguing alternative for those seeking to exploit the momentum of the Nasdaq-100 index, while simultaneously hedging against potential downsides.

- PSQ's leveraged allocation to the Nasdaq-100 can significantly enhance profits during upward market situations.

- However, it's crucial to understand that this magnification can also magnify losses during negative markets.

- Therefore, a comprehensive appreciation of PSQ's investment characteristics is essential for traders to effectively implement it into their portfolios.

By judiciously evaluating market conditions and synchronizing PSQ's characteristics with their investment goals, market participants can potentially survive through volatile market situations.

Dissecting PSQ ETF Returns in a Bullish Market

When the market is bullish, investors analyze every opportunity to boost returns. The PSQ ETF, which tracks the performance of the NASDAQ-100 Index, has gained significant interest in recent months as investors hunt exposure to expansion stocks.

Despite this, understanding the nuances of PSQ ETF returns in a bullish market can be challenging. There are diverse factors that affect its performance, extending from macroeconomic trends to specific company outcomes.

Here's a detailed look at key considerations:

* The robust overall market sentiment can strongly impact PSQ ETF returns. When investors are optimistic about the future, they are more likely to allocate capital into growth stocks, which fuel the NASDAQ-100's growth.

* Innovative advancements and sector-specific trends can further influence PSQ ETF returns. For example, accelerated demand for artificial intelligence or cloud computing services can benefit certain companies within the index, leading to higher returns for the ETF as a whole.

* It's imperative to assess the market capitalization of the PSQ ETF in contrast to its historical averages and benchmarks. A high valuation could point towards that the market is already expecting future growth, which could cap further growth in ETF returns.

Understanding these factors can help investors steer the PSQ ETF landscape and educated investment choices in a bullish market.

The Potential and Risks of PSQ ETF for Short Sellers

Short selling the ProShares Strategy (PSQ) can be a profitable endeavor, but it also comes with significant risks. A successful short trade relies on the underlying index declining in value. In the case of PSQ, which is designed to amplify the inverse returns of the Nasdaq 100, a negative market trend can lead to substantial gains. However, short selling also carries inherent exposure, as any unexpected upswing in the Nasdaq 100 could result in substantial losses.

Additionally, PSQ's multiplier can exacerbate both profits and losses, making it a risky investment strategy. Traders considering short selling PSQ must have a comprehensive understanding of the market dynamics, risk management techniques, and the potential for unexpected price movements.

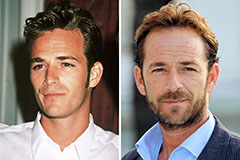

Luke Perry Then & Now!

Luke Perry Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!